Mobile Home Insurance: What You Need to Know

15 Min Read | Oct 25, 2023

Mobile homes are getting a bit of a rebrand these days. Sure, the old-school shoebox style is still going strong. But lots of mobile home manufacturers are leveling up with designs that look a lot more like traditional homes.

Still, anything built on a moveable (towable) chassis isn’t going to grow in value like a traditionally built home. And that’s the main reason why we don’t recommend you go out and buy one (we're not talking about RVs). But—if you already own a mobile home, we do want to make sure you’re doing all you can to protect the investment you made.

And that means insurance.

And just like homeowners insurance, mobile home insurance offers all the coverage options you need to protect your home and belongings.

Let’s go over everything you need to know.

What Is Mobile Home Insurance?

Types of Mobile Home Insurance Coverage

What Is the Difference Between Mobile Home Insurance and Modular Home Insurance?

What Does Mobile Home Insurance Cover?

What Doesn’t Mobile Home Insurance Cover?

How Much Mobile Home Insurance Do I Need?

How Much Does Mobile Home Insurance Cost?

What Affects Mobile Home Insurance Rates?

Do You Need Mobile Home Insurance?

Get the Right Mobile Home Insurance

What Is a Mobile Home?

Technically, the term “mobile home” only refers to manufactured, moveable homes built before 1976. Now hang in there—we know people still talk about mobile homes all the time (you may even be thinking, Hey wait—I live in a mobile home, and it’s not from the 70s!). It really comes down to what the government calls them and what us regular Joes call them.

Usually, when we hear the term mobile home we think of a long metal box on a trailer (that’s why we also call them trailers). But the term mobile home can be confusing when you start getting into the weeds. That’s because the government put out some strict standards for these types of homes and started calling anything like this built after 1976 a “manufactured” home. So basically, all mobile homes built before 1976 are still called mobile homes by the government, but all those built after are called manufactured homes—even though they may seem like pretty much the same thing.

But people still refer to these manufactured homes as mobile homes because, well, that’s what we’ve always called them, and they can be moved. They have a permanent steel I-beam chassis and wheels underneath them.

Bottom line: These days the terms mobile home and manufactured home are pretty much interchangeable. Unless you’re the government.

Types of Mobile Homes

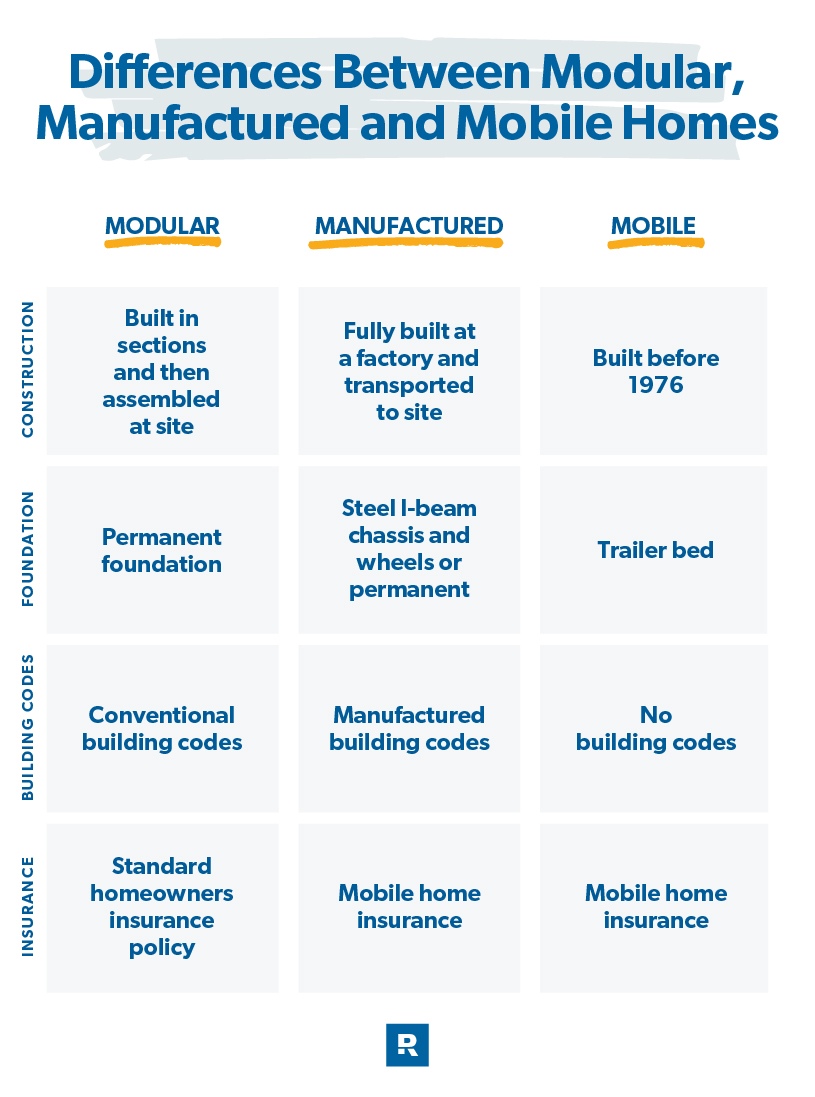

Figuring out what exactly a mobile home is gets even more confusing when you hear terms like prefabricated home, modular home, and manufactured home. And you need to have this sorted out to pick the right insurance.

So what’s the difference?

Prefabricated home: Any kind of housing that’s built at a facility and then moved to the site is considered prefabricated. These aren’t considered a mobile home. Most prefab homes are insured under a regular homeowners policy.

Modular home: This kind of dwelling falls under the prefab umbrella but is more specific. Modular homes are built in at least two sections and then brought to the site on a flatbed truck. Modular homes aren’t considered mobile homes either. They’re built to conventional building codes.

Manufactured home: With this kind, the structure is fully constructed in a factory and then transported to a site. The steel I-beam chassis and wheels are the most recognizable difference that sets manufactured homes apart from other prefab homes.

Protect your home and your budget with the right coverage!

Mobile home: Like we said earlier, technically a mobile home is a home on wheels built before 1976, but many people still use this term to refer to modern manufactured homes that are built to be moved.

Tiny house on wheels: Although there are many differences between a manufactured home and a tiny house, in some states like Tennessee, tiny homes are classed as mobile homes.

|

What’s the Difference? |

||||

|

Type |

Construction |

Foundation |

Building Codes |

Insurance |

|

Modular Home |

Built in sections and then assembled at site. |

Permanent |

Conventional |

Standard homeowners insurance policy |

|

Manufactured Home |

Fully built at a factory and transported to site |

Steel I-beam chassis and wheels or permanent |

Manufactured |

Mobile home insurance |

|

Mobile Home |

Built before 1976 |

Trailer bed |

None |

Mobile home insurance |

What Is Mobile Home Insurance?

Mobile home insurance (aka manufactured home insurance) provides financial protection in case your home is damaged or destroyed. It covers your belongings, the structure, and legal and/or medical costs if someone gets hurt or their property is damaged while they’re on your property.

Some mobile-home owners might think they can skip insurance since they don’t own a more traditional, expensive home. That’s a mistake. Not only are mobile home costs rising, but the structures themselves are also more vulnerable to damage caused by natural events—windstorms, for example—than traditional homes.1

Having insurance is a big part of your defensive financial plan. It transfers your risk to the insurance company—if something goes wrong, they pay to repair or replace your stuff. So, unless you have the cash to pay for all of that out of pocket, you need insurance for your mobile home.

Types of Mobile Home Insurance Coverage

Dwelling Coverage

Dwelling coverage pays to repair or replace the structure of your mobile home if it’s damaged by events your policy covers. These events typically include:

- Fire and lightning

- Explosions

- Vandalism

- Theft

- Falling objects

- Wind and hail

- Weight of ice and snow

- Damage from wild or stray animals

- Burst pipes

We recommend you buy enough dwelling coverage to cover the cost to replace your mobile home if it’s completely destroyed.

Personal Property

Personal property coverage typically pays to repair or replace your stuff, including furniture, electronics and other belongings, if they’re damaged or stolen in a covered event.

For example, let’s say your newish leather sofa is ruined by water from a burst pipe. Or your new laptop is stolen by a burglar. Since burst pipes and theft are both covered events, your insurance company would kick in here to help (after you pay your deductible, of course).

Keep in mind, though, that standard mobile home insurance policies cover your stuff on an actual cash value (ACV) basis. Actual cash value means they’ll pay the replacement cost of your couch or laptop minus depreciation (wear and tear). But hey, getting some cash back is better than nothing.

Other Structures

In addition to your home, you can insure other unattached structures like sheds and garages on your property. Likely, if a storm blows through and takes out your mobile home, it’ll take out other structures too. So, if you’ve got a building or several apart from your home, it’d be a good idea to make sure they’re covered too.

Liability

Liability insurance pays out if a visitor is hurt on your property and sues you.

For example, let’s say your neighbor is over borrowing a teaspoon of vanilla extract during a tornado and is injured by a tree falling on your property. If that neighbor sues you and you have liability insurance, your insurance company would cover legal defense and medical fees up to your coverage limit. Now, that example is a little extreme, but trees (and people) fall over all the time without wind to help.

It’s completely up to you to decide how much liability insurance you want to carry. Consider getting enough to at least cover your net worth. Worst case scenario is that someone sues you for everything you own.

Here’s a tip. Every mobile home insurance policy can be tailored to fit each homeowner’s needs. Maybe you want to make sure your carport is included in your policy. Or maybe you’re curious about additional living expenses if your home is so damaged that you have to live elsewhere while it’s being repaired.

Whatever your needs are, talk to an independent insurance agent to learn more about how you can customize your policy.

What Is the Difference Between Mobile Home Insurance and Modular Home Insurance?

Like we went over earlier, modular homes and manufactured homes are constructed differently and built to different codes. These differences mean they’re also insured differently. Because modular homes are built to standard construction codes, they’re insured by a standard homeowners policy, while mobile homes are built to HUD manufactured home codes and are insured through mobile home insurance (or manufactured home insurance, same thing).

Standard homeowners insurance and mobile home insurance policies have a lot of similarities. They both cover dwelling, contents, other structures and liability.

The biggest difference between the two is how insurance companies value your home. With a regular house, insurers will either pay you the cost to replace it (ACV) or pay you up to the coverage limit to replace or repair it depending on your policy—known as replacement value coverage (RCV). With a standard mobile home insurance policy, insurers will value your home at its actual cash value (ACV). So, unless you specifically buy a replacement cost policy (and we recommend you do!), insurance will only pay what you would get for your mobile home if you sold it on the open market. This is very similar to how car insurance works if you think about it.

Protect your home with the right insurance.

Having a RamseyTrusted pro by your side means you’ll get quality insurance coverage without breaking the bank.

What Does Mobile Home Insurance Cover?

The exact coverage of a mobile home insurance policy depends entirely on what type of policy you purchase. But in general, this is what a typical policy covers:

A policy will pay out to replace or repair your actual mobile home structure, unattached structures like a shed or garage, all your stuff inside your home, and medical and legal fees if someone gets hurt on your property and sues you.

When it comes to replacing or repairing the items listed above (aka home, stuff, sheds, etc.), the damage must be caused by these events:

- Fire and lightning: If Thor pays your home sweet mobile home a visit, you’re covered.

- Explosions: You know, on the off chance your mobile home becomes the set of the next Michael Bay movie. Or the gas explodes.

- Vandalism: If the local hoodlums decide to spray their latest art installment on the side of your home, no worries—you’re covered.

- Theft: If people take your stuff, you can get more stuff. But just remember, if you don’t pay extra for RCV coverage, you’ll only get the used value of your stuff.

- Falling objects: Technically, this could be a piano or the world’s largest pizza, but it’s more likely to be a tree limb, meteor or piece of an airplane.

- Wind and hail: Hopefully you’re inside when these things happen, that way your mobile home insurance can cover the damage instead of your health insurance.

- Weight of ice and snow: If your roof can’t handle the weight of winter and caves in, your insurance company will pay.

- Damage from wild or stray animals: If a bear comes along, decides what you’re cooking in your kitchen smells pretty good, and rips out the window to dig in, your insurance will cover the new window.

- Burst pipes: It happens. Pipes don’t always do their job. If yours go on strike, you can rest assured the expense will be covered.

What Doesn’t Mobile Home Insurance Cover?

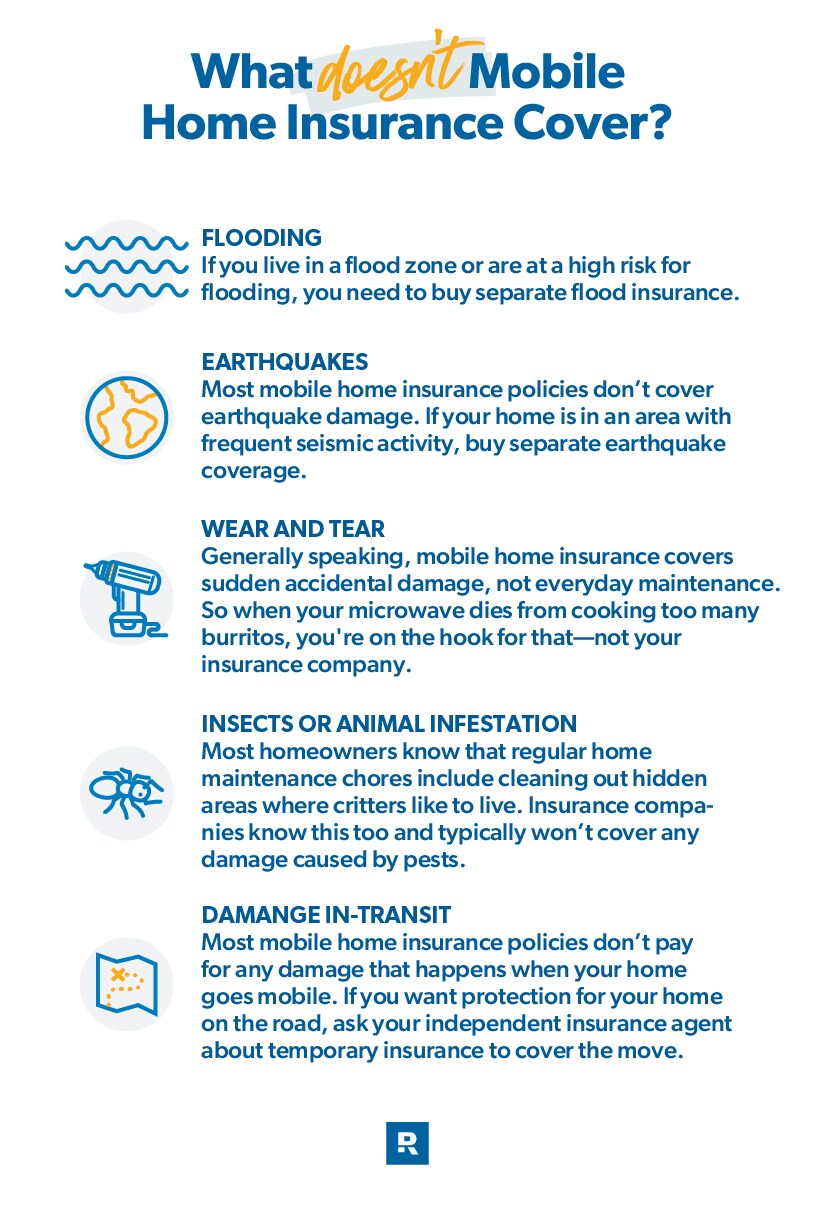

To successfully customize your policy, you should know what standard mobile home insurance doesn’t cover:

- Flooding: If you live in a flood zone or are at a high risk for flooding, you need to buy separate flood insurance.

- Earthquakes: Most mobile home insurance policies don’t cover earthquake damage. If your home is in an area with frequent seismic activity, buy separate earthquake coverage.

- Wear and tear: Generally speaking, mobile home insurance covers sudden accidental damage, not everyday maintenance. Remember that leather sofa we mentioned? Even though leather usually looks better when it’s worn in, insurance companies just consider it used.

- Insect or animal infestation: Most homeowners know that regular home maintenance chores include cleaning out hidden areas where critters like to live. Insurance companies know this too and typically won’t cover any damage caused by pests.

- Damage in-transit: Most mobile home insurance policies don’t pay for any damage that happens when your home goes mobile. If you want protection for your home on the road, ask your independent insurance agent about temporary insurance to cover the move.

The more you know about what mobile home insurance does and doesn’t cover, the better you’ll be able to tell your agent exactly what you want.

How Much Mobile Home Insurance Do I Need?

Basically, the rule is if you can’t comfortably replace it out of your savings, you need to fully insure it. That means if you can’t afford to pay the difference between what insurance will give you for the depreciated value of your stuff and what it actually costs to get new stuff, you should get a replacement cost value rider for your personal property. Same goes for your mobile home structure.

When it comes to liability, how much you need depends on your net worth (because the idea is to protect you from getting cleaned out if someone sues you). Generally, you should get as much as you can afford. At the bare minimum, buy $300,000, but better yet get $500,000.

The more liability coverage you have, the better you’ll be protected. If you have $500,000 in coverage instead of $100,000, your insurance company has more on the line as well and will be more inclined to put up their best defense for you.

How Much Does Mobile Home Insurance Cost?

The cost of mobile home insurance is affected by factors like the age and condition of your mobile home, your deductible, your claims history, and location. So it’s tough to give a specific number, but you can expect to pay a few hundred to over $1,000 a year. That’s a small price to pay for financial peace of mind.

More good news. You can determine the price of your mobile home insurance by adjusting the coverage limits. The best way to do that is to work with one of our trusted pros who can tell you exactly how to customize your policy and how much it’s going to cost.

Mobile Home Insurance Discounts

Just like with regular homeowners insurance, there are things you can do to save a little money when purchasing a mobile home insurance policy.

You might be able to score a discount if you:

- Are the original owner of the mobile home

- Install security devices like burglar and smoke alarms

- Bundle your insurance (so buy your auto and mobile home policies from the same carrier)

- Pay your premium in full once a year

- Go paperless and receive all communication and do all your payments online

- Use an independent insurance agent (they can shop around and find you the best deal with discounts that work with what you have)

What Affects Mobile Home Insurance Rates?

The truth is not all insurance rates are created equal. Sometimes you can end up paying more for the same amount of coverage. Why is that? Well, you might’ve gotten a raw deal (go with an independent insurance agent to make sure you’re paying the lowest price). But in some cases, certain factors in your situation may just mean you cost more to insure.

Here are some of the common factors that affect your mobile home insurance rate:

- Location: Where you live plays a big role because some areas have higher crime or higher incidence of natural disasters.

- Coverage limits: How much liability you buy and whether you have RCV or ACV coverage for your structure and personal property will push your rate up or down.

- Age and condition of home: If you’re trying to insure a rust box from the 80s, you’re going to pay more. But if you have a newer manufactured home, it isn’t likely to fall apart as soon, and insurance will be cheaper.

- Deductible size: The bigger your deductible (how much you pay before insurance kicks in), the smaller your premium.

- Claims history: If you’ve filed a lot of insurance claims in the past, a company is going to see that and think, They’ll probably file again with us—and charge you a higher premium.

- Discounts: If you can get those discounts, your rate will be lower.

Do You Need Mobile Home Insurance?

Like we mentioned before, mobile home insurance is a must if you don’t have the money to repair or replace your home in case of a natural disaster or cover losses from a lawsuit. Or both!

While it’s not required by law, it is typically required by mortgage companies and mobile home communities.

Get the Right Mobile Home Insurance

Instead of spending hours online comparing prices and getting a flurry of marketing emails from random insurance companies, the smartest way to find the best mobile home insurance policy is to reach out to one of our RamseyTrusted local pros. They’re experts on insurance in your area and will know how to get you the best deal based on your situation.

Plus, they’re all independent agents. That’s a big deal. It means that instead of being tied to one agency’s product, our pros can shop around for you to find the right policy at the best price.