Turns out, there are a lot of budgeting apps out there. Why? Well, for one—people want a more convenient way to budget. An on-the-go app can make budgeting way easier to keep up with. It puts your budget right in your hands. Literally. And that’s great.

Another reason is that all these different apps offer slightly different things. They’re built on various money philosophies and have all kinds of features.

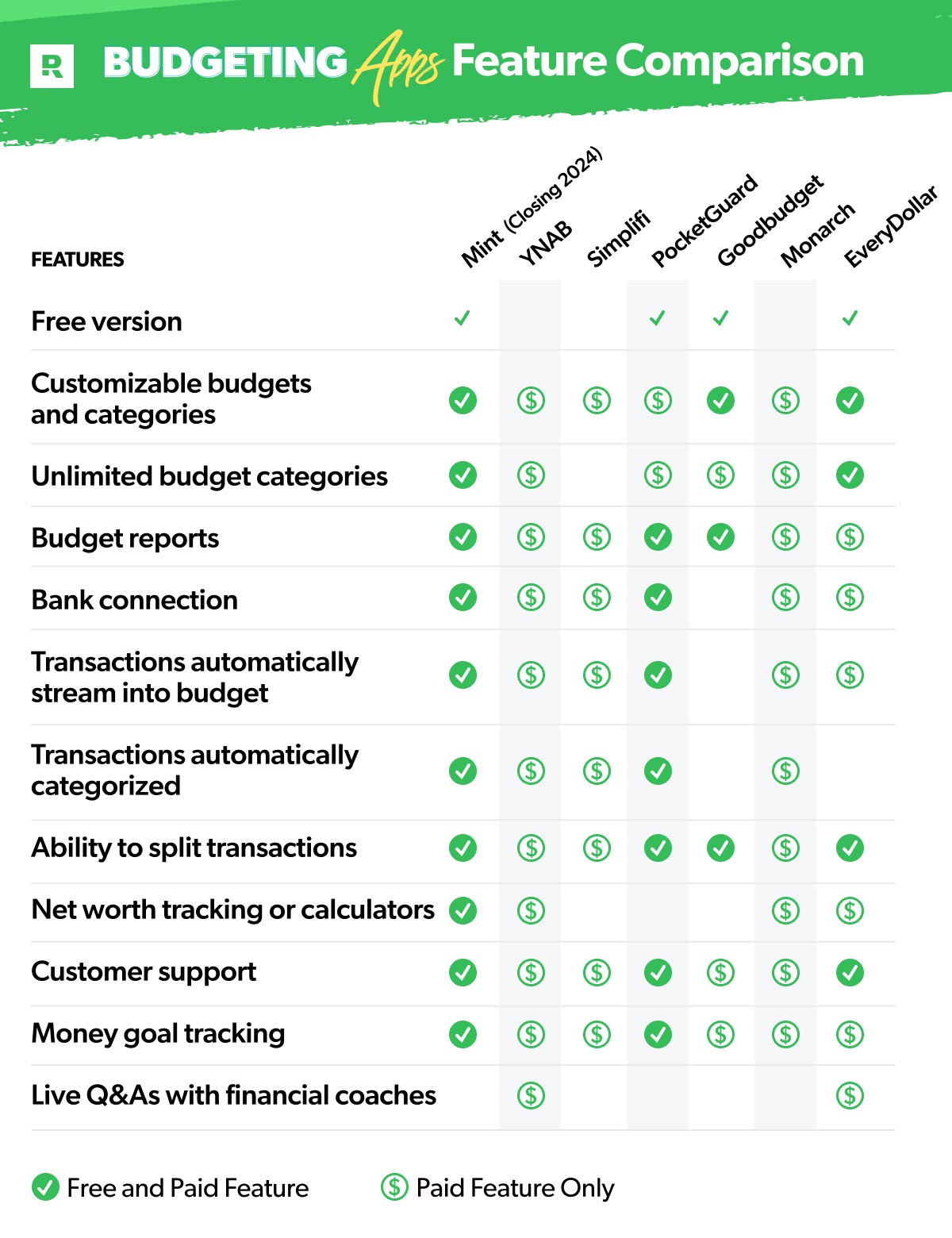

It can feel kind of overwhelming when you look at them all, so I wanted to compare seven of the most popular budgeting apps out there right now. We’re talking cost comparisons, feature highlights, ratings from users and some reviews from actual budgeters. Oh, and I’ve got a chart at the end of the article with all this information broken down to make it easy to see it all in one spot.

Alright. Let’s get started!

2024 Budgeting Apps

Mint

YNAB

Simplifi

PocketGuard

Goodbudget

Monarch

EveryDollar

Budgeting Apps Comparison Chart

Mint

Mint Overview

Mint was one of the most popular budgeting apps out there before they announced they’ll be shutting down this year. They were part of the Intuit family of products—meaning they were related to TurboTax, QuickBooks, Credit Karma and Mailchimp.

Mint automated a lot of the budgeting process for a more hands-off budgeting approach—so budgeters engaged less with their money overall.

Mint had a free version, or you could upgrade to their premium option for more features.

Even though they’re on the way out, we’re still going to look at what they had to offer since most of their features were really popular.

Cost

- Free for classic features (one person per account)

- $4.99 per month for Mint Premium

Free Features Included

- Customize budgets

- Get financial insights into your spending and saving

- Set due date notifications

- Connect to multiple financial accounts in one app

- Have your transactions automatically categorized

- Track your net worth

- Check your credit score for free

Paid Features Included

All the free budgeting features, plus:

- Get help canceling unwanted subscriptions

- Remove ads

- Compare your spending habits to other Mint budgeters

- Check out projected monthly spending

Ratings and Reviews of the Mint Budgeting App

4.8 App Store, 4.0 Google Play

First off, the net worth tracker looked like an awesome feature. And Mint users loved that they could wrangle all their money management in one place. Getting your complete financial picture in one spot does sound great! I love when things are clear like that.

And you’d think having a budgeting app automatically sort your transactions into categories would be the best thing ever. Essentially, when you connected your bank account to your budget, Mint decided where your transactions should go. They did all the tracking for you.

But here’s the deal: One of the biggest complaints reviewers pointed out was that Mint often chose the wrong budget category. That makes sense, honestly, because you know when you stop by Target you can end up buying diapers for the Baby budget line, a cardigan for your Clothing budget line, and orange juice for your Groceries budget line.

Mint didn’t know, but they sorted out all your transactions like they knew. They could have seen Target and dropped that entire transaction right into Groceries. Then you’d have to go in and fix it after the fact. So, the effort to streamline your budgeting on the front end could make extra work for you on the back end.

Also, you guys, Mint led budgeters to be way too hands-off with their money. Yes, it’s nice to have some of the work done for you with budgeting—but being inside your budget is actually key to being in charge of your money.

You should actively tell your money where to go. Every month. Spending in and of itself isn’t wrong, but you should feel it. And putting your transactions where they belong helps you feel it and see what’s happening to your money. This is so important.

Also, Mint ads didn’t have a budgeter’s best interests at heart. They promoted credit cards, loans and other pro-debt products. Mint had no problem encouraging debt, and I just can’t get behind that.

I want you to be in control of your money. That means tracking your transactions yourself. That means owning your finances—not owing on debt. Even with the good stuff Mint offered, these things were deal breakers for me.

And then Mint announced they were shutting down, and all they offered the four million people budgeting with them was the chance to move their data over to Credit Karma.

But get this—Credit Karma doesn’t even offer budgeting! Yes, they have a spot for customers to see all their financial accounts, net worth and transactions in one place. But they don’t have an actual budgeting tool.

If you were using Mint and need a new budgeting app, keep reading to see how all these alternatives stack up!

YNAB (You Need a Budget)

YNAB Overview

YNAB is a budgeting tool built on four rules. First, to give your money jobs to do (aka use the zero-based budgeting method). Second, to embrace your true expenses, which means you budget some money each month to break bigger, infrequent expenses up so you can pay cash when they’re due. Third, to roll with the punches, which means to adjust your budget and move money from one category to another if needed. And fourth, to “age your money,” which is where you save up a full month of income so you can pay this month’s bills with last month’s money.

Cost

- $14.99 per month

- $99 per year

Free Features Include

- None

Paid Features Include

- Create a monthly budget

- Access your budget on your computer, phone or tablet

- Customize budget categories and lines

- Set and track goals

- Securely connect your bank account to your budget

- See spending and net worth reports

- Use the loan calculator

- Split transactions

- Talk to a live person for customer support

- Join live Q&A sessions with YNAB teachers

- Get tracking recommendations for your manual transactions

- Have your transactions categorized automatically

Ratings and Reviews of the YNAB Budgeting App

4.8 App Store, 4.6 Google Play

Though YNAB says they’re all about being less automated and more hands-on, they also auto-categorize your transactions. Yep. That’s the exact opposite of hands-on. One three-star rating I found pointed this out and complained that this feature makes the app difficult to use.

Again, you guys, an app doesn’t know when your Amazon purchase is seamless hair ties for your Fun Money line (yeah, that’s my new favorite purchase) or toilet paper for your Home Goods line. But you do.

Tell your money where to go, and watch where it’s going, okay?

As far as money philosophies go, YNAB built their app on some of the same principles we’ve been teaching at Ramsey Solutions for over 30 years, so you might see some similarities there. But they’re really into rolling over money in budget lines from month to month.

Now, this is different from a sinking fund, where you intentionally save up each month for a bigger purchase or an irregular expense. Sinking funds are super important. But if you have money left in a regular budget line, I don’t want you rolling it over to spend next month. I want you to put it toward your Baby Step. That’s how you’ll make real progress with your goals.

Simplifi

Simplifi Overview

Quicken created Simplifi to offer a less hands-on budgeting tool that does most of the work for you. It sets up a budget automatically based on your previous spending habits.

Cost

- $3.99 per month

- $47.88 per year

Free Features Include

- None

Paid Features Include

- Connect to multiple financial accounts in one app

- Get your budget set up for you

- Set and track goals

- See budget reports

- Get built-in tax reports

- Get cash-flow projections

- Have your transactions automatically categorized

- Get real-time spending alerts

Ratings and Reviews of the Simplifi Budgeting App

4.0 App Store, 3.2 Google Play

One of the biggest draws to Simplifi is how they can connect your budget to your bank account and loans—which should help you manage all your finances in one spot.

But one reviewer gave two stars, saying they’ve been using the app for years but Simplifi can’t get their act together. Another said glitches in the app mean they often can’t budget on their phone and have to “put it off until I’m in front of a computer.” This seems to be a trend.

Also, let’s talk about their encouragement to hide or ignore spending. I’m not joking. Their website says this app will help you “Easily ignore any spending that you don't want to count toward your monthly budget.”1 Seriously?

Listen, I’m a natural spender. But ignoring or hiding a purchase defeats the whole point of budgeting! A budget is a plan for your spending. All of it! It’s a way to be accountable to yourself, your spouse (if you’re married) and your money goals.

Pretending you didn’t spend money is straight-up lying! And the person you hurt the most in this case is yourself.

PocketGuard

PocketGuard Overview

With a free and paid version to offer, PocketGuard’s main goal is to show budgeters how much money they have left to spend. They do this by featuring what’s “in my pocket,” aka how much you haven’t budgeted toward bills, goals or necessities.

PocketGuard is very hands-off, encouraging users to interact with the app pretty much only to see what’s left “in my pocket” to spend—to help prevent overspending.

Cost

- Free for classic features

- $12.99 per month for PocketGuard Plus

- $74.99 per year for PocketGuard Plus

Free Features Include

- Connect to multiple financial accounts in one app

- Have your transactions automatically categorized

- See budget reports

- Get notifications when you’re close to overspending on a budget line

- Get third-party offers for other financial services

- Create savings goals (limited amount)

Paid Features Include

All the free budgeting features, plus:

- Connect to unlimited financial accounts

- Create custom budget categories

- Create unlimited budget categories

- Change the posted date on a transaction

- Set up a personalized debt payoff plan

- Export transaction data

- Import transaction history

- Create unlimited savings goals

- Split transactions into different categories

Ratings and Reviews of the PocketGuard Budgeting App

4.6 App Store, 3.6 Google Play

Once again, an app automatically putting your transactions where it thinks they should go doesn’t work well. When your budget puts your spending in the wrong spot, you have to go in afterward and clean up the mess made by AI with good (but poorly directed) intentions.

I do appreciate that there’s a free version! That’s great to have options when you’re a budgeter. But why doesn’t the free version allow you to add in your own custom categories? That seems like a very basic ask for a basic budget.

Also, as far as free vs. paid features go, several people complain about not being able to change the date on transactions that stream in unless you have the paid version.

Goodbudget

Goodbudget Overview

Goodbudget offers online and in-app budgeting based on the envelope system. Budgeters make digital envelopes for every budget category and can add in planned amounts.

Cost

- Free for standard version

- $8 per month for Goodbudget Plus

- $70 per year for Goodbudget Plus

Free Features Include

- Use up to 20 envelopes (categories)

- Have one account

- Access on two devices

- See one year of history

- Track debt

- Get community support

- Split transactions

- Set due dates for bills

- Sync and share your household budget

Paid Features Include

- Use unlimited envelopes (categories)

- Have unlimited accounts

- Access on five devices

- See seven years of history

- Track debt

- Get email support

- Split transactions

- Set due dates for bills

- Sync and share your household budget

Ratings and Reviews of the Goodbudget Budgeting App

4.6 App Store, 4.1 Google Play

Okay, you know I love using the envelope method. I’m glad Goodbudget sees value in it too! But one review called Goodbudget “onerous,” and another said it was “cumbersome.” Yeah, they’re pulling out the big vocabulary here to say the app takes lots of effort and can be a burden.

Those weren’t the only reviews calling out the difficulty in setting up or using the app. You guys, I don’t think setting up or using a budgeting app should be “onerous” or a burden. Effort? Some. Onerous? Never.

Also, several people complained about the limited amount of budget categories in the free version, and yes, there is a paywall that unlocks more categories, but again, unlimited categories is such a basic feature for a free budgeting app.

Monarch Money

Monarch Money Overview

Created by a team of designers and developers, Monarch Money launched in 2020. Their goal was to make a financial tool that helps you build good habits and reach your money goals.

Cost

- $14.99 per month

- $99.99 per year

Free Features Include

- None

Paid Features Include

- Access your budget on your computer, phone or tablet

- Customize budget categories

- Schedule annual expenses

- Automatically stream transactions into your budget

- Have your transactions automatically categorized

- Connect to multiple financial accounts in one app

- Get notified of upcoming expenses

- See and create custom budget reports

- Split transactions

- Submit a request for customer support

- Track your net worth

- Create and track unlimited money goals

- Export transaction data

Ratings and Reviews for the Monarch Money Budgeting App

4.8 Apple Store, 4.6 Google Play

Looking over all of Monarch’s offerings, their net worth tracking is a plus, and the ability to make as many custom reports on whatever tiny part of your budget you want to is a bonus for any budget nerd.

But one review explains the app might say your account balances have just been updated, but the numbers will be way off. Another complained about the lack of a paycheck planning feature. And a couple reviews complained about customer support being super slow, or worse, even never replying! (You never want to be ghosted by customer support.)

Just like a few of the other apps on here, Monarch automatically categorizes your transactions. And I’ve already explained how hard it is for an app to understand how to sort your complicated purchases. Plus, it takes you out of the driver’s seat of your budget. No thank you.

Also, once again, we’ve got a budgeting app that encourages you to hide transactions. “Sometimes transactions aren’t relevant,” Monarch website explains.2

This just isn’t true. If money is coming in or out of your life, it’s relevant! It should be in your budget. That’s how you take control of every single dollar and actually get ahead with your money.

EveryDollar

EveryDollar Overview

EveryDollar uses the zero-based budgeting method, an approach where you give every dollar a purpose or job. (That’s where the app’s name came from!) This method brings accountability and helps budgeters keep up with their entire income by assigning all of it to giving, saving and spending.

Budgeters can use the free version of EveryDollar forever, test out the premium features of the tool in a free trial at any time, and upgrade for $79.99/year.

Cost

- Free for standard version

- $17.99 per month for the premium features

- $79.99 per year for the premium features

Free Features Include

- Create monthly budgets

- Access your budget on your computer, phone or tablet

- Customize budget categories and lines for all your monthly expenses

- Create unlimited budget categories and lines

- Set up sinking funds and track savings goals

- Split transactions

- Set due dates for bills

- Talk to a live human being for customer support

Premium Features Include

All the free budgeting features, plus:

- Connect to multiple financial accounts in one app

- See custom budget reports

- Export transaction data

- Join live Q&A sessions with professional financial coaches

- Automatically stream your transactions into your budget

- Get tracking recommendations for your transactions

- Set due date reminders for your bills

- Calculate your current and projected net worth

- Plan your spending based on when you get paid and when things are due with paycheck planning

- Set big-picture goals and see a timeline of when you’ll hit them with the financial roadmap feature

Ratings and Reviews of the EveryDollar Budgeting App

4.7 App Store, 3.4 Google Play

Here are the things I love best about EveryDollar. First, it’s set up to use the zero-based budgeting method. When you reach a zero-based budget, you see “It’s an EveryDollar budget” at the top of the app. If you’re off, it tells you exactly what’s left to budget or how much you’re over. You can keep tweaking until you get to zero. That’s great guidance and affirmation while you’re budgeting. Love that.

Next, EveryDollar encourages you to interact with your money. With the free version, you manually enter all your transactions. You can also upgrade to the premium version and have your transactions stream into your budget—but they won’t auto-categorize.

It’s super simple to go in, see your transactions that have already shown up, and drag and drop them into the right spot. Then you see how much money you’ve got left in that budget line. Fantastic accountability, but also oh so simple. It’s the perfect balance.

Save more. Spend better. Budget confidently.

Get EveryDollar: the free app that makes creating—and keeping—a budget simple. (Yes, please.)

One of the biggest complaints for EveryDollar is the cost of the premium version. And you guys, I get it. If you know me, you know I love a good deal—so if I’m going to spend my money, I want to know it’s worth it.

First I want to remind you that the free version of EveryDollar is great. Really. If you want a free app for zero-based budgeting to help you stay in control of your money, use this version!

And if you want an upgraded experience, all the good stuff that comes with the paid version of EveryDollar makes it so worth the cost.

There are the classic features—like the bank connectivity and transaction streaming—that are some of my personal favorites. You also can see custom budget reports right there in the app to compare how your spending habits line up to your money goals. It’s pretty eye-opening sometimes.

But there’s even more. Set reminders and have push notifications sent a few days before a bill or payment is due. Jump in on live Q&As with professional financial coaches and other budgeters just like you. See your current and projected net worth. All inside your budgeting tool.

There’s even a newer feature called financial roadmap that helps you set your big-picture goals and see the timeline of when you’ll reach each one—plus how a little extra work or savings can speed up your progress!

There’s also a feature called paycheck planning that helps you set up your budget based on when expenses are due and when you get paid—so you aren’t worried about running out of money between paychecks.

Yes, EveryDollar is the Ramsey Solutions budgeting app, so I’m going to sound a little biased. But that’s because it was built on all the principles we’ve been teaching for over 30 years and gives you access to all the things we know will help you win with money!

I love EveryDollar because it lines up with what I teach about money, gives you options (free vs. paid with all those extras), and puts you in the driver’s seat with your whole financial future.

Budgeting is how you stay in control of your money. And that’s what I want for you. No more wondering where your money is going. Just a clear, intentional plan. That’s how you’ll go from where you are right now to where you want to be.

You can do this, you guys. Get started budgeting today!

Budgeting Apps Comparison Chart

Get—and Stay—in Control of Your Money

A budget is how you get there. And yeah, there are a lot of budgeting app options—but EveryDollar is our personal favorite.

Start EveryDollar for Free